Just How to Keep Compliant with International Laws While Going After Offshore Investment

Just How to Keep Compliant with International Laws While Going After Offshore Investment

Blog Article

All Concerning Offshore Financial Investment: Insights Into Its Considerations and benefits

Offshore financial investment has come to be an increasingly appropriate subject for individuals seeking to expand their portfolios and boost financial safety. While the possible advantages-- such as tax optimization and property protection-- are compelling, they include an intricate landscape of risks and regulative difficulties that call for mindful consideration. Comprehending both the advantages and the challenges is vital for any individual pondering this investment technique. As we discover the subtleties of offshore investment, it becomes apparent that educated decision-making is crucial for maximizing its potential advantages while minimizing integral risks. What elements should one prioritize in this complex atmosphere?

Recognizing Offshore Investment

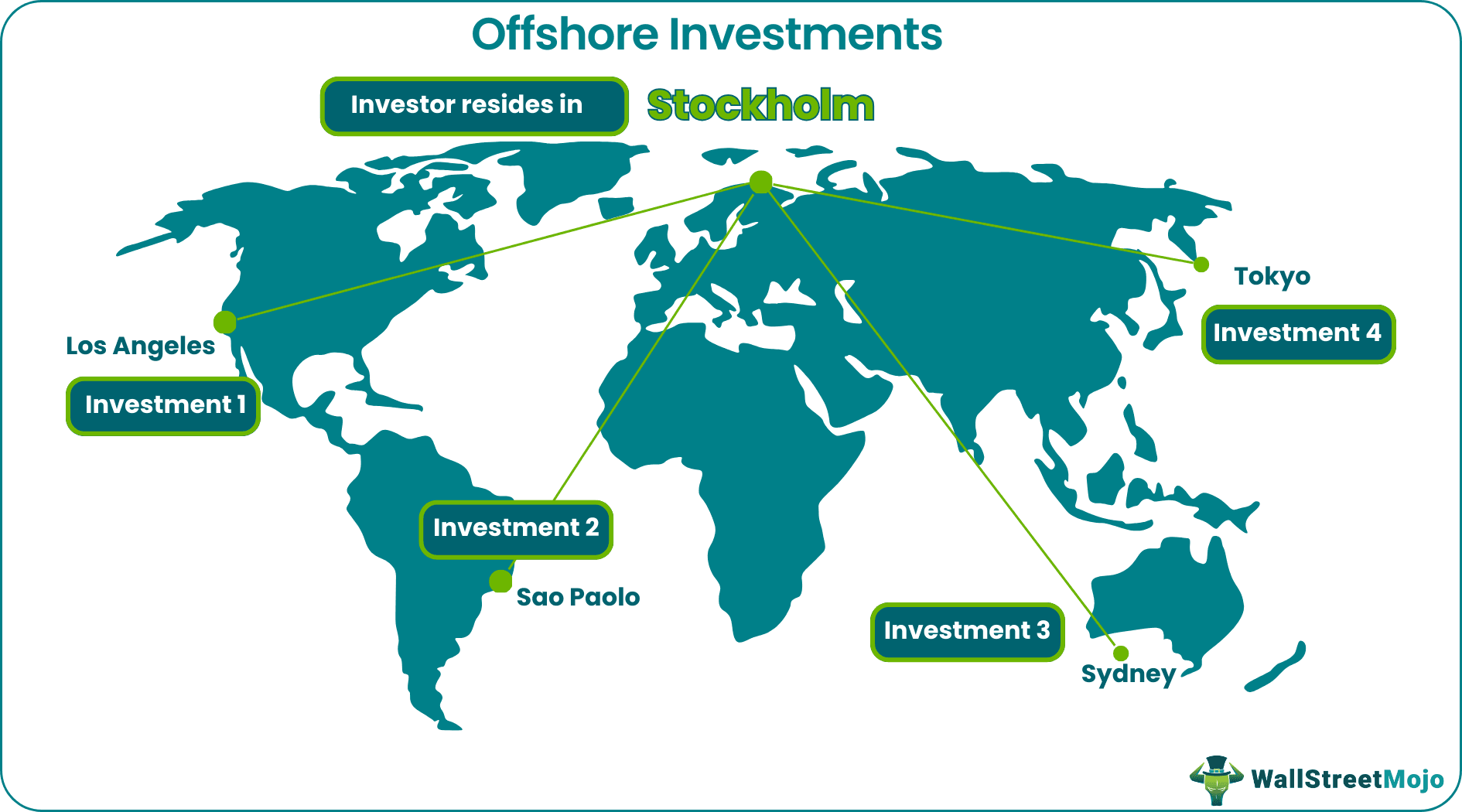

In the world of global finance, comprehending offshore financial investment is important for individuals and entities seeking to enhance their monetary portfolios. Offshore financial investment describes the placement of properties in banks outside one's country of residence. This technique is frequently used to achieve numerous monetary goals, consisting of diversification, property security, and potential tax obligation advantages.

Offshore investments can encompass a wide selection of monetary tools, including supplies, bonds, shared funds, and property. Capitalists may pick to establish accounts in jurisdictions understood for their positive regulatory settings, privacy regulations, and financial stability.

It is necessary to identify that offshore financial investment is not naturally synonymous with tax obligation evasion or immoral tasks; instead, it serves legit purposes for several investors. The inspirations for taking part in overseas investment can differ widely-- from seeking greater returns in industrialized markets to safeguarding possessions from political or financial instability in one's home country.

Nonetheless, possible financiers have to also understand the complexities included, such as compliance with international policies, the requirement of due diligence, and comprehending the legal effects of overseas accounts. Generally, a comprehensive understanding of overseas financial investment is vital for making educated economic choices.

Trick Advantages of Offshore Investment

Offshore investment offers numerous vital advantages that can improve a financier's monetary technique. This can significantly increase general returns on investments.

In addition, offshore investments frequently supply accessibility to a more comprehensive series of investment opportunities. Capitalists can diversify their profiles with properties that may not be readily offered in their home countries, including international supplies, genuine estate, and specialized funds. This diversification can reduce threat and enhance returns.

Furthermore, offshore financial investments can facilitate estate planning. They allow capitalists to structure their assets in a manner that minimizes inheritance tax and guarantees a smoother transfer of riches to beneficiaries.

Typical Threats and Challenges

Buying offshore markets can provide various dangers and difficulties that call for mindful consideration. One significant threat is market volatility, as overseas financial investments might undergo fluctuations that can affect returns dramatically. Investors need to likewise be mindful of geopolitical instability, which can disrupt markets and impact investment performance.

Another challenge is currency danger. Offshore financial investments usually entail purchases in foreign money, and undesirable exchange price motions can wear down revenues or boost losses. Offshore Investment. In addition, limited accessibility to dependable information about overseas markets can impede enlightened decision-making, causing prospective mistakes

Lack of regulatory oversight in some overseas territories can additionally present risks. Investors may locate themselves in settings where capitalist security is minimal, enhancing the threat of fraudulence or mismanagement. In addition, varying monetary practices and social mindsets toward financial investment can make complex the investment procedure.

Regulative and lawful Considerations

While navigating the complexities of overseas investments, understanding the regulatory and lawful landscape is important for guarding properties and making sure compliance. Offshore financial investments are usually subject to a plethora of legislations and regulations, both in the investor's home nation and the jurisdiction where the financial investment is made. Therefore, it is necessary to conduct thorough due diligence to understand the tax effects, reporting requirements, and any lawful obligations that might arise.

Regulative structures YOURURL.com can differ dramatically between territories, influencing everything from taxation to funding needs for international investors. Some countries may use favorable tax obligation regimes, while others enforce strict guidelines that can prevent financial investment. In addition, international agreements, such as FATCA (Foreign Account Tax Compliance Act), might obligate investors to report offshore holdings, enhancing the requirement for openness.

Financiers need to additionally know anti-money laundering (AML) useful link and know-your-customer (KYC) guidelines, which call for economic organizations to confirm the identification of their clients. Non-compliance can lead to serious fines, consisting of penalties and constraints on financial investment tasks. Involving with lawful professionals specializing in worldwide investment regulation is essential to navigate this elaborate landscape efficiently.

Making Enlightened Choices

A tactical approach is essential for making educated decisions in the world of offshore financial investments. Understanding the intricacies entailed needs extensive research and evaluation of various factors, consisting of market trends, tax obligation implications, and lawful frameworks. Capitalists have to evaluate their threat tolerance and financial investment goals, ensuring positioning with the distinct features of offshore possibilities.

Scrutinizing the regulatory environment in the chosen jurisdiction is important, as it can considerably affect the safety and security and success of investments. Furthermore, staying abreast of geopolitical growths and financial conditions can supply beneficial insights that educate financial investment strategies.

Engaging with professionals that concentrate on offshore financial investments can additionally boost decision-making. Offshore Investment. Their competence can assist financiers via the complexities of global markets, helping to identify potential pitfalls and lucrative opportunities

Ultimately, informed decision-making in offshore investments pivots on a versatile understanding of the landscape, a clear articulation of individual purposes, and a commitment to continuous education and adjustment in a vibrant global setting.

Final Thought

Finally, overseas financial investment presents substantial advantages such as tax optimization, possession security, and access to international markets. It is vital to recognize the connected risks, consisting of market volatility and regulative obstacles. A complete understanding of the legal landscape and thorough research study is vital for effective navigation of this facility arena. By attending to these considerations, capitalists can efficiently harness the advantages of offshore investments while minimizing possible disadvantages, inevitably resulting in educated and strategic monetary choices.

Offshore financial investment offers several key advantages that can improve a financier's economic approach.Additionally, offshore financial investments usually provide pop over here access to a broader range of investment possibilities. Differing financial practices and cultural attitudes toward investment can complicate the financial investment process.

Report this page